PUBLISHING PARADISE: WHAT WOULD AN AD-FREE FACEBOOK LOOK LIKE?

Jan 16, 2024

MARK MCCORMICK

The Magazine Manager

Meta announced last fall that it would be launching a subscription service in the EU, giving Facebook and Instagram users the option to pay for an ads-free experience.

And the reactions and hypothetical questions this proposal prompted were instant and only continue to snowball.

SIDESTEPPING PRIVACY CONCERNS

TechCrunch quickly criticized the plan, saying it attempts to circumvent privacy rulings by giving users a “pay us or be tracked” ultimatum. Shortly thereafter, noyb, an Austrian privacy rights group, filed a complaint, saying the cost of safeguarding one’s privacy with such a subscription — which works out to just over $10 per month for each Facebook account — is out of proportion to the value Meta derives in tracking.

In its complaint, the group plays out the hypothetical “domino effect” of other app companies adopting Meta’s approach, estimating that the average EU citizen with 35 apps on their smartphone would “have to pay a ‘fundamental rights fee’ of €8,815.80 a year” (or approximately $9,629).

“More than 20% of the EU population are already at risk of poverty,” says Max Schrems, noyb’s founder and chairman. “For the complainant in our case, as for many others, a ‘Pay or Okay’ system would mean paying the rent or having privacy.”

AD SPEND GOING ELSEWHERE

Shortly after Meta’s announcement, Forbes’ Chris Walton explored the shift in retail advertising should this concept make its way to the United States. Influencers with dedicated followings and big-name omnichannel retailers like Wal-Mart and Target would benefit the most from the expected decline in ad-spending on social media.

“Savvy media buyers will no doubt begin to look to large-scale, national retail media networks as a means to reach their high-value customers who might otherwise become unreachable through traditional social media advertising,” Walton writes. “Meta, in an almost ‘careful what you wish for strategy,’ could thus inadvertently become like the pied piper of retail advertising, leading brands to diversify their ad investments into retail ecosystems that offer one-to-one relationships without the filter of social media at all.”

Neil Patel, in a newsletter sent out early January, predicted how this Meta model might play out for marketers in America, saying it would “reduce views/clicks from the most lucrative subscribers — those who have money to blow.”

“Studies show that people who don’t blink at recurring fees have more disposable income,” he writes. “The average user is on 6.6 social platforms. If each platform did a $10 subscription, that’s $72/month. For heavy social media users, that totals $720+ per year.”

PRIME TIME FOR PUBLISHERS?

For now, speculating and hypothetical pre-planning are about all we can do as Meta’s subscription model takes shape in Europe and casts shadows here in America.

Looking at it from a publisher’s perspective — as my company, my blog-writing, and our publishing software like Magazine Manager have strived to do for so long — I can’t help but think a Meta subscription model here in America could help ease the pain for publishers competing in the social media ad arena.

I look at Patel’s breakdown of heavy social-media users, and while no advertiser would want to completely ignore the big-whale eyeballs, there are plenty of other fish in these particular seas.

Half of American adults get their news from social media at least some of the time, according to a recent Pew Research Center study, and Facebook in particular is still a heavy-hitter for those consumers, with 30% regularly getting their news there (followed by YouTube at 26%, Instagram at 18%, TikTok at 14%, Twitter / X at 12%, and Reddit at 8%).

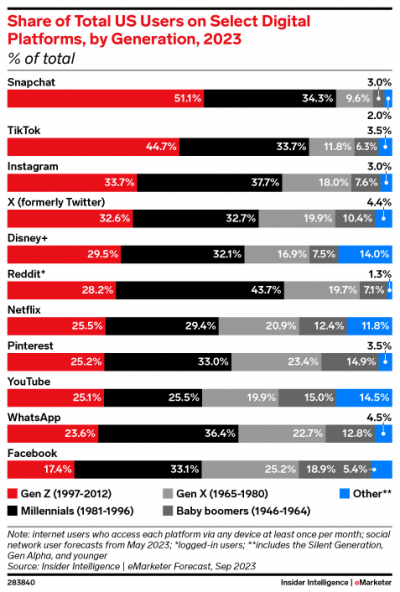

Sure, on a generational level, Facebook may be considered part of an older guard of digital platforms. A recent Insider Intelligence study found it ranked below most of those previously mentioned news-consuming digital platforms for both Gen Z and Millennials.

But consider TikTok, whose 14% share in the Pew Research Center study was up from 3% in 2020 and rising popularity is undeniable, even for publishers.

43% of regular TikTok users said they get their news from the site. Even if, as MediaPost’s Steven Rosenbaum points out, clickbait comes up prominently alongside other recognized sources on TikTok, blurring the definition of news — and especially if TikTok “also raises questions about the credibility, accuracy, and bias of the sources and content that users encounter there,” as Rosenbaum says — that thirst for news and opportunity for legitimate publishers is there, on emerging platforms as it is on established ones.

In an ad-free social media environment — be it Facebook or TikTok — publishers with high-quality content can better reach their audiences without the low-quality clutter clogging feeds.

Privacy issues and big-name ad-spenders would likely always persist, but should Facebook or other social-media platforms offer a subscription option, it could clear some space for publishers to thrive and find their best audiences.

No one would deem that a return to the glory days by any means, but as a breath of fresh air and valuable room to grow, what publisher could resist?